Understanding the Importance of a Diversified Portfolio

A diversified portfolio is a cornerstone of prudent investing, designed to spread risk across various asset classes, industries, and geographic regions. This strategy aims to optimize returns while minimizing the impact of any single investment’s performance on the overall portfolio. Here’s a comprehensive look at what a diversified portfolio entails and why it is crucial for investors:

What is a Diversified Portfolio?

Definition:

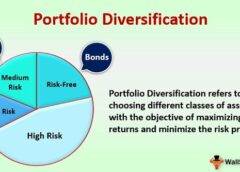

A diversified portfolio consists of a mix of different types of investments that are not closely correlated with each other. This includes:

– Asset Classes: Such as stocks, bonds, real estate, commodities, and cash equivalents.

– Geographic Regions: Investments across different countries and regions to mitigate regional economic risks.

– Industry Sectors: Spread investments across various sectors like technology, healthcare, consumer goods, and energy.

Why is Diversification Important?

1. Risk Management:

– Reduction of Single-Asset Risk: By spreading investments across different asset classes, industries, and regions, investors can reduce the impact of a decline in any single investment on the overall portfolio.

– Market Volatility Mitigation: Different asset classes perform differently under various market conditions. Diversification helps smooth out volatility and potentially improve risk-adjusted returns.

2. Enhanced Potential for Returns:

– Capture Growth Opportunities: Diversification allows investors to participate in growth sectors and asset classes while minimizing the risk associated with concentrated investments.

– Optimization of Risk-Return Profile: Balancing higher-risk, higher-reward investments (e.g., stocks) with lower-risk, stable investments (e.g., bonds) can enhance the portfolio’s overall risk-adjusted return potential.

3. Adaptation to Changing Market Conditions:

– Resilience to Economic Shifts: A diversified portfolio is better positioned to withstand economic downturns or changes in market trends that may impact specific sectors or asset classes.

– Opportunity to Seize Emerging Trends: Exposure to diverse investments increases the likelihood of benefiting from emerging opportunities in different markets or industries.

4. Long-Term Stability and Consistency:

– Consistent Income and Growth: Diversified portfolios typically generate more stable and predictable income streams from dividends, interest payments, and capital appreciation over time.

– Alignment with Financial Goals: Whether saving for retirement, funding education, or achieving other financial milestones, a well-diversified portfolio supports long-term financial objectives.

Building a Diversified Portfolio

1. Asset Allocation:

– Strategic Allocation: Determine the appropriate mix of asset classes based on your financial goals, time horizon, and risk tolerance.

– Rebalancing: Periodically adjust the portfolio to maintain the desired asset allocation, ensuring it remains aligned with your investment objectives.

2. Risk Assessment and Management:

– Risk Tolerance: Evaluate your risk tolerance to establish a portfolio that balances potential returns with your comfort level during market fluctuations.

– Asset Class Selection: Choose asset classes with different risk profiles to diversify effectively without overexposing your portfolio to any single type of risk.

3. Research and Due Diligence:

– Investment Selection:Conduct thorough research on individual investments to ensure they align with your investment strategy and contribute to portfolio diversification.

– Professional Guidance:Consider consulting with a financial advisor to develop a personalized investment plan that incorporates diversification principles tailored to your needs.

Conclusion

A diversified portfolio is not just a strategy for spreading risk—it is a fundamental approach to optimizing investment returns while safeguarding against market volatility and economic uncertainties. By combining various asset classes, industries, and geographic regions, investors can achieve a balanced risk-return profile that supports their financial goals over the long term. Whether you are aiming for growth, income, or preservation of capital, diversification remains a cornerstone of sound investment practice, providing stability, resilience, and potential for consistent returns in an ever-changing financial landscape.