Understanding Different Types of Investments

Investing is a crucial aspect of building wealth and achieving financial goals, but navigating the diverse landscape of investment options can be overwhelming for beginners. Each type of investment offers unique benefits and risks, tailored to different financial objectives and risk tolerances. Here’s a comprehensive guide to the various types of investments available:

1. Stocks

– Definition: Stocks, or equities, represent ownership in a company. When you buy stocks, you become a shareholder and participate in the company’s profits (through dividends) and losses.

– Risk and Return: Stocks offer potentially high returns but come with higher volatility and risk. Prices can fluctuate based on company performance, economic conditions, and market sentiment.

2. Bonds

– Definition: Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. When you buy a bond, you’re lending money to the issuer in exchange for periodic interest payments and the return of the bond’s face value at maturity.

– Risk and Return: Bonds are generally considered lower risk than stocks but offer lower potential returns. They can provide income through regular interest payments.

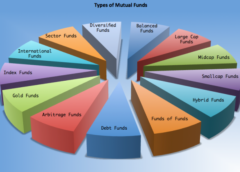

3. Mutual Funds

– Definition: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities managed by a professional fund manager.

– Risk and Return: Mutual funds vary in risk depending on their underlying assets. They offer diversification benefits and are suitable for investors seeking professional management and diversification in a single investment.

4. Exchange-Traded Funds (ETFs)

– Definition: ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They typically track an index, commodity, or basket of assets and aim to replicate its performance.

– Risk and Return: ETFs combine the diversification of mutual funds with the flexibility of stocks. They can offer lower fees than mutual funds and provide liquidity through trading on exchanges.

5. Real Estate

– Definition: Real estate investments involve purchasing properties (residential, commercial, or land) to generate income through rental payments or appreciation in property value.

– Risk and Return: Real estate investments can provide rental income and potential capital appreciation. They can be less liquid than stocks or bonds and require ongoing maintenance and management.

6. Certificates of Deposit (CDs)

– Definition: CDs are time deposits offered by banks with fixed interest rates and maturity dates. Investors deposit money for a specified period (e.g., 6 months to 5 years) and receive interest upon maturity.

– Risk and Return: CDs are low-risk investments insured by the FDIC (for banks in the U.S.). They offer predictable returns but typically have lower yields compared to stocks or mutual funds.

7. Commodities

– Definition: Commodities are physical goods such as gold, oil, agricultural products, or metals that can be traded on commodity exchanges.

– Risk and Return: Commodities can provide diversification and a hedge against inflation. Their prices are influenced by supply and demand dynamics, geopolitical factors, and global economic trends.

8. Alternative Investments

Definition: Alternative investments include hedge funds, private equity, venture capital, and cryptocurrencies. These investments typically have higher barriers to entry and may offer unique risk-return profiles not found in traditional assets.

– Risk and Return: Alternative investments can provide opportunities for higher returns but come with increased complexity, liquidity risks, and regulatory considerations.

Conclusion

Diversifying your investment portfolio across different asset classes can help manage risk and optimize returns based on your financial goals and risk tolerance. Understanding the characteristics, risks, and potential returns of each investment type is essential for making informed investment decisions. Consider seeking advice from a financial advisor to tailor an investment strategy that aligns with your objectives and financial situation. Remember, a well-balanced and diversified portfolio is key to achieving long-term financial success and weathering market fluctuations effectively.