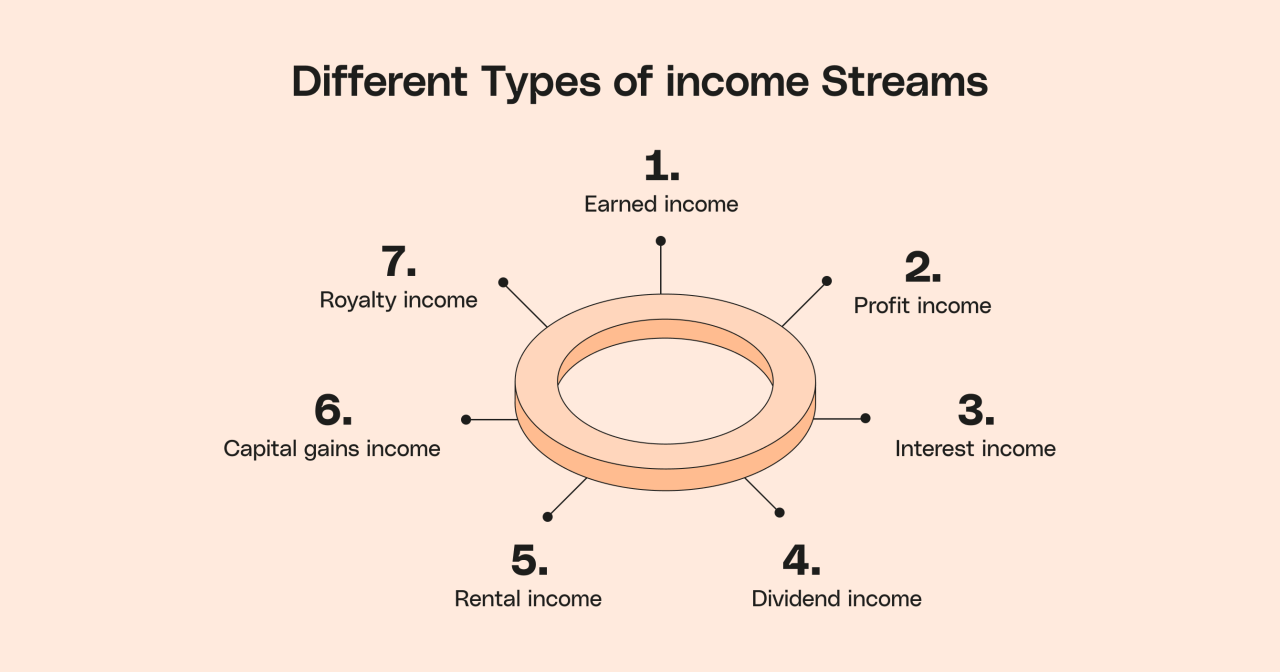

In today’s uncertain economic landscape, relying solely on a single source of income can be risky. Building multiple streams of income is a proactive way to enhance your financial stability, reduce reliance on a single paycheck, and ultimately achieve financial freedom. Here are some effective strategies to consider for generating diverse income streams.

1. Investing in Stocks and Bonds

Stocks

Investing in individual stocks or exchange-traded funds (ETFs) can lead to capital appreciation and dividends. This strategy allows you to benefit from the growth of established companies while earning income through dividends.

Bonds

Consider investing in government or corporate bonds for a more stable source of income. Bonds typically pay interest at regular intervals, providing a steady income stream.

2. Real Estate Investments

Rental Properties

Purchasing residential or commercial properties can yield significant rental income. Managing rental properties requires effort but can be a lucrative long-term investment.

Real Estate Investment Trusts (REITs)

For those who prefer a hands-off approach, investing in REITs allows you to earn dividends from real estate without owning physical properties. REITs are traded on stock exchanges, providing liquidity and ease of access.

3. Start a Side Business

E-commerce

Launching an online store to sell products through platforms like Shopify or Amazon can create a significant income stream. Identify niche products or unique offerings to stand out in the competitive market.

Freelancing

If you possess marketable skills, freelancing can be an excellent way to generate extra income. Offer services in writing, graphic design, programming, or consulting on platforms like Upwork or Fiverr.

4. Create Passive Income Streams

Online Courses

Sharing your expertise by developing online courses can be a rewarding venture. Platforms like Udemy and Teachable allow you to reach a broad audience and earn money passively as students enroll.

E-books

Writing and self-publishing e-books on topics you’re passionate about can provide ongoing royalties and reach a global audience through platforms like Amazon Kindle.

5. Dividend Stocks

Invest in companies that consistently pay dividends to enjoy regular income without the need to sell shares. This strategy combines the potential for capital appreciation with income generation.

6. Peer-to-Peer Lending

Utilize platforms such as LendingClub or Prosper to lend money to individuals or small businesses. This can offer attractive interest rates, making it a viable source of passive income.

7. Affiliate Marketing

Promoting products or services through your website or social media channels can generate income through affiliate marketing. Earn commissions for each sale made through your referral link without managing inventory.

8. Invest in Index Funds

Index funds offer a diversified investment portfolio with lower fees. By tracking specific market indexes, they provide a balanced approach to investing and potential for steady returns.

9. Royalties from Creative Works

If you’re a creator, explore the possibility of earning royalties from your music, art, or patents. This passive income stream can provide financial rewards over time.

10. Participate in the Gig Economy

Take advantage of platforms like Uber, TaskRabbit, or Upwork to earn extra income on your schedule. The gig economy offers flexible opportunities to supplement your main income.

11. Network Marketing

Joining a reputable network marketing company can allow you to earn commissions based on product sales and recruitment. Choose companies with proven products and ethical practices to ensure long-term success.

12. Licensing Your Ideas

If you have a unique product or idea, consider licensing it to companies for a fee or royalties. This strategy enables you to leverage your creativity without managing production and sales.

13. Invest in Mutual Funds

Mutual funds managed by professionals provide exposure to various assets without requiring in-depth market knowledge. They offer diversification and potential for growth, making them a suitable choice for many investors.

14. Savings Accounts and CDs

Utilizing high-yield savings accounts or certificates of deposit (CDs) can provide safe, interest-bearing options for your cash reserves. Although returns are lower compared to stocks, they offer stability and liquidity.

Tips for Success

- Diversify: Aim for a mix of income sources to mitigate risk. Relying on a single stream can be detrimental if that source falters.

- Educate Yourself: Continuously learn about different investment strategies and income opportunities to make informed decisions.

- Start Small: Begin with one or two income streams, then expand as you gain confidence and experience.

- Be Patient: Building multiple streams of income takes time and effort. Stay committed to your goals and remain patient through the process.

Creating multiple streams of income is not just a strategy for wealth building; it is a way to enhance your overall financial well-being. By implementing these strategies, you can achieve greater financial security and have the freedom to pursue your passions and interests