Tax-free investments in Kenya offer an excellent opportunity to grow your wealth while minimizing your tax burden. From government bonds to real estate investment trusts (REITs) and savings accounts, these investment vehicles can help you maximize returns while keeping more of your money. Here’s a guide on the top tax-free investment options in Kenya.

1. Government Bonds

Government bonds in Kenya are among the most popular tax-free investment vehicles, offering both security and competitive interest rates. The Kenyan government issues various bonds, such as infrastructure bonds, which are completely tax-free. These bonds provide steady, predictable income through interest payments, making them ideal for risk-averse investors.

Key Benefits:

- Guaranteed interest payments.

- Completely tax-exempt for infrastructure bonds.

- Minimum investment from as low as Kshs 50,000.

How to Invest:

- Purchase bonds through the Central Bank of Kenya (CBK) or a licensed stockbroker.

2. Tax-Free Savings Accounts

In Kenya, certain savings products, such as M-Akiba, are tax-exempt and accessible to everyone via mobile phones. These tax-free savings accounts offer attractive interest rates and allow you to save regularly while earning a return without worrying about tax deductions.

Key Benefits:

- Easy to open and manage through mobile platforms.

- No taxes on earned interest.

- Secure and low-risk.

How to Invest:

- Open an M-Akiba savings bond through the mobile platform or buy it through a stockbroker.

3. Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) are another excellent tax-free investment option in Kenya, allowing you to invest in the property market without buying real estate outright. REITs pool funds from many investors to buy and manage income-generating properties such as malls, offices, and residential units.

Kenya offers Income REITs (I-REITs), which are tax-exempt on income earned from rental properties, making it a perfect option for those looking to earn passive income.

Key Benefits:

- Exposure to the real estate market without the need for substantial capital.

- Tax-free rental income.

- Potential for long-term capital appreciation.

How to Invest:

- Purchase shares of listed REITs on the Nairobi Securities Exchange (NSE).

Maximizing Returns with a Balanced Portfolio

Combining these tax-free investment options is a powerful way to maximize returns while enjoying the benefits of tax-exemption. A balanced portfolio that includes government bonds, tax-free savings, and REITs can provide you with both steady income and long-term capital growth.

Here are some investment tips to consider:

- Diversify: Spread your investments across multiple tax-free options.

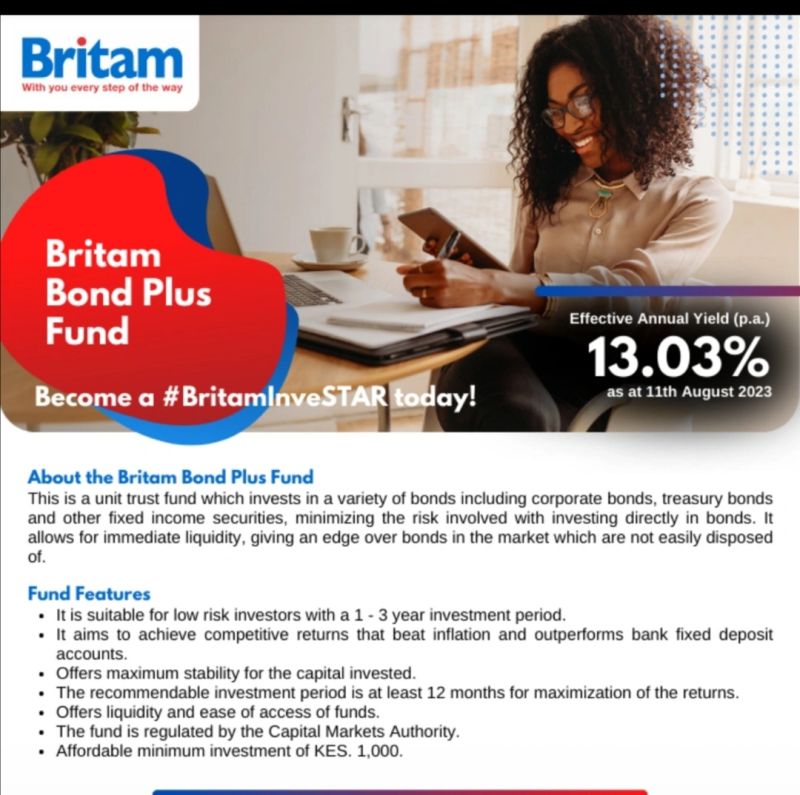

- Research Interest Rates: Look for the highest-yielding bonds or savings accounts.

- Monitor REITs: Track their performance and choose those with a history of stable income.

- Long-Term Focus: Commit to long-term investments to fully leverage compounding returns.

Conclusion

Kenya’s tax-free investment options offer an incredible opportunity for investors to grow their wealth while minimizing tax liabilities. Whether you opt for secure government bonds, flexible tax-free savings accounts, or high-potential REITs, these investments can help you achieve financial freedom.