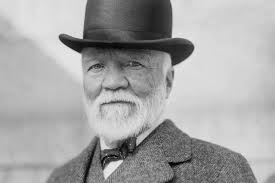

Andrew Carnegie, the Scottish-American industrialist and philanthropist, transformed the steel industry and became one of the wealthiest individuals in history. His journey from a poor immigrant to a financial titan offers valuable insights for today’s investors and entrepreneurs. This article explores key lessons from Carnegie’s life that remain relevant in today’s fast-paced financial landscape.

1. The Power of Perseverance and Optimism

Carnegie faced considerable challenges early in life, including poverty and lack of formal education. Despite these obstacles, he maintained a positive outlook and was determined to succeed. His story emphasizes the importance of mental toughness and optimism in overcoming adversity. In a world where setbacks are common, resilience can be a game-changer.

2. Go Beyond Expectations

One of Carnegie’s core principles was to exceed the expectations of employers and clients. He believed in taking initiative and constantly seeking to improve. By going above and beyond, he positioned himself for advancement and success. This principle can be applied in any career or business: striving to deliver exceptional value can set you apart from the competition.

3. Lifelong Learning

Carnegie was a strong advocate for continuous education. Despite lacking a formal background, he was an avid reader and sought mentorship from experts in various fields. His commitment to learning allowed him to adapt to changes in the steel industry and seize emerging opportunities. In today’s ever-evolving economy, staying informed and enhancing your skills is essential for long-term success.

4. Strategic Investing

Carnegie’s early investment experiences taught him the significance of generating income through capital. He often emphasized the importance of making informed financial decisions. Investing wisely—whether in stocks, real estate, or business ventures—can be the key to building wealth over time. Carnegie’s approach highlights the necessity of doing thorough research and understanding market trends before making investment choices.

5. Seizing Opportunities

Recognizing and acting on opportunities was a hallmark of Carnegie’s success. He was known for his ability to make quick decisions, whether it was accepting a job offer or selling stocks. In the dynamic world of finance, being proactive can lead to significant advantages. This means being ready to act when opportunities arise, rather than waiting for the “perfect” moment.

6. Define Clear Goals

Carnegie believed in setting specific financial goals rather than vague aspirations. He encouraged individuals to articulate their desired outcomes clearly and establish timelines for achieving them. Setting measurable goals helps maintain focus and motivation, guiding decision-making and strategies toward financial success.

7. Learn from Mistakes

Carnegie’s life was not without failures, but he viewed them as learning experiences. He adjusted his strategies based on past mistakes, emphasizing that growth often comes from failure. This lesson is particularly relevant today, as entrepreneurs and investors face uncertainties and challenges that can lead to setbacks.

Conclusion

Andrew Carnegie’s life and principles provide timeless lessons for anyone aiming to achieve financial success. His emphasis on perseverance, continuous learning, strategic investing, and goal-setting resonates strongly in today’s economy. By applying these insights, modern investors can navigate challenges and seize opportunities to build lasting wealth.