Securing long-term financial stability is a prudent goal, and one effective way to achieve it is through strategic investments. Government bonds, particularly those offering tax-free interest, are a reliable and low-risk investment option. This article explores the benefits of these bonds, the available tax-free options, and how to set up a consistent monthly investment plan for 7 to 10 years.

Understanding Government Bonds

Government bonds are debt securities issued by a government to support government spending and obligations. When you invest in these bonds, you are essentially lending money to the government, which in return, promises to pay you back with interest over a specified period. The primary advantage of government bonds is their low risk since they are backed by the government.

#Benefits of Tax-Free Government Bonds

1. Tax Savings:

One of the most significant advantages of tax-free government bonds is the exemption from federal, and sometimes state and local, income taxes on the interest earned. This feature can result in substantial tax savings, making them an attractive option for investors in higher tax brackets.

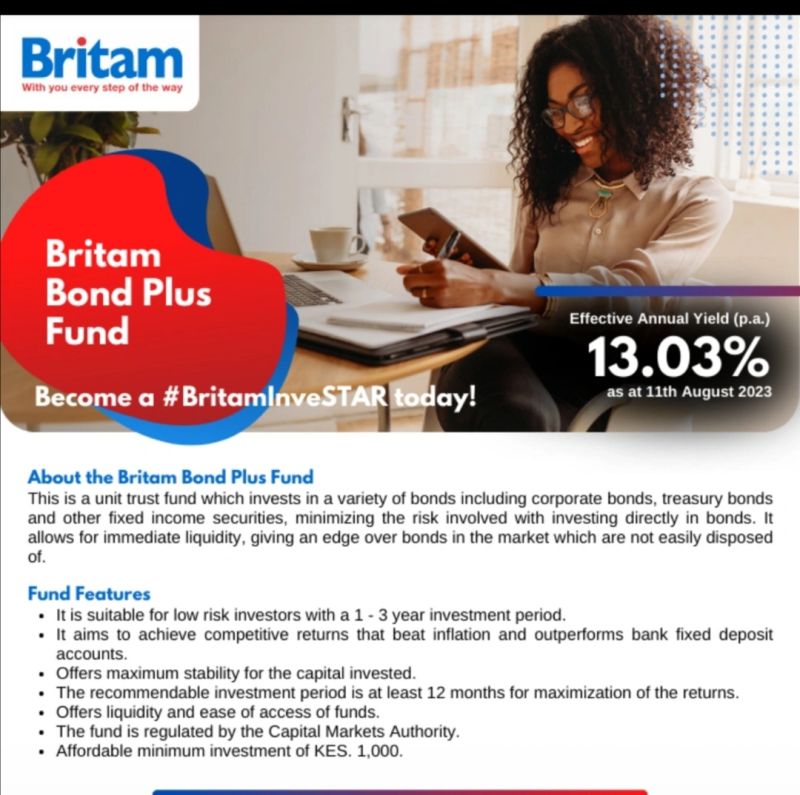

2. Stable Returns:

Government bonds typically offer fixed interest rates, providing a predictable and stable return on investment. This stability makes them a good option for conservative investors seeking to preserve capital.

3. Low Risk:

As these bonds are issued by the government, they carry a low risk of default. This security makes them a safe investment, especially during economic downturns or market volatility.

Available Tax-Free Government Bond Options

While specific options may vary depending on your country, here are some common types of tax-free government bonds:

1. Municipal Bonds (Muni Bonds):

In the United States, municipal bonds are issued by states, cities, and other local government entities. The interest earned is typically exempt from federal income taxes and, in some cases, state and local taxes if you reside in the state where the bond is issued.

2. Tax-Free Savings Bonds:

Some countries offer savings bonds that provide tax-free interest. These bonds are generally geared towards long-term savings goals and come with fixed interest rates.

3. Zero-Coupon Bonds:

These bonds are sold at a discount and do not pay periodic interest. Instead, they mature at their face value, with the difference between the purchase price and the face value representing the interest earned, which can sometimes be tax-free.

Setting Up a Monthly Investment Plan

Investing consistently over time can significantly enhance your financial stability. Here’s how to set up a monthly investment plan for government bonds:

1. Determine Your Investment Amount:

Assess your financial situation to decide how much you can comfortably invest each month. Ensure this amount aligns with your long-term financial goals.

2. Select the Right Bonds:

Choose the tax-free government bonds that best suit your needs. Consider factors like the bond’s maturity period, interest rate, and any tax implications.

3. Automate Your Investments:

Many financial institutions offer services to automate monthly investments. Set up an automatic transfer from your bank account to purchase bonds each month.

4. Monitor Your Portfolio:

Regularly review your investment portfolio to ensure it meets your financial goals. Adjust your investment strategy as needed based on changes in your financial situation or market conditions.

Conclusion

Investing in tax-free government bonds can be a powerful strategy to achieve long-term financial stability. With their tax advantages, stable returns, and low risk, they are an excellent choice for conservative investors. By setting up a consistent monthly investment plan, you can steadily build your wealth over 7 to 10 years, securing your financial future.