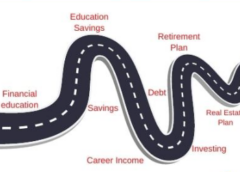

A financial plan is a crucial document detailing a person’s current financial circumstances and their short- and long-term monetary goals, along with strategies to achieve those goals. This guide will walk you through the essentials of financial planning, helping you establish and plan for fundamental needs like managing life’s risks, income, spending, and debt reduction.

Key Elements of a Financial Plan

1. Understanding a Financial Plan

A financial plan is a detailed document outlining an individual’s short- and long-term financial goals, with a strategy to achieve them. It should be comprehensive, highly customized, and reflect personal and family financial needs, investment risk tolerance, and plans for saving and investing. Financial planning starts with calculating one’s current net worth and cash flow, providing guidance over time, and tracking progress towards financial goals.

2. Calculating Net Worth

To calculate your current net worth, subtract your liabilities from your assets. Assets include property of value you own, such as a home, car, cash in the bank, and investments. Liabilities include debts such as bills, credit card debt, student loans, mortgages, and car loans.

3. Determining Cash Flow

Cash flow is the money you take in measured against what you spend. Documenting your personal cash flow helps determine monthly necessities, available savings and investments, and where you can cut back on spending. Review checking account and credit card statements to get a complete history of income and spending across various categories.

4. Establishing Your Goals

Clear financial goals are crucial in a financial plan. These goals might include funding education, buying a home, starting a business, retiring, or leaving a legacy. A professional financial planner can help finalize a detailed savings plan and specific investments to achieve these goals.

Benefits of a Financial Plan

A financial plan provides a thorough examination of your income and spending, improves your understanding of your financial circumstances, and establishes important short- and long-term financial goals. It clarifies actions required to achieve various financial goals, enhances the probability of achieving financial milestones, and provides a means to monitor your progress, reducing financial stress and worry.

Reasons for a Financial Plan

Financial planning is essential for keeping your financial house in order, regardless of age, earnings, net worth, or financial dreams. It helps document personal and financial goals, keeps people on track to meet ongoing financial needs, and adapts to significant life changes like new jobs, income changes, major life events, health adversities, or income windfalls.

Creating and Maintaining Your Financial Plan

1. DIY or Professional Help

Decide whether to create your financial plan independently or with a licensed financial planner. A financial professional can ensure that your plan covers all essentials.

2. Building an Emergency Cash Fund

Set aside enough money in a liquid account to cover all expenses for at least six months, preferably twelve, to prepare for unexpected events.

3. Reducing Debt and Managing Expenses

Eliminate debt as quickly as possible to grow savings and improve your standard of living. Regularly cut expenses to add to your savings and stay on top of known expenses like taxes to meet obligations on time.

4. Managing Potential Risks

Plan for appropriate insurance coverage to protect your financial security during accidents, health problems, or the death of loved ones. This includes home, property, health, auto, disability, personal liability, and life insurance.

5. Planning to Invest

Participate in a retirement plan at work, maximize tax-advantaged investing with a personal IRA, and allocate available income to taxable investment accounts to grow your net worth. Tailor your investment plan to your risk tolerance and future income needs.

6. Including a Tax Strategy

Reduce income taxes with deductions, credits, and tax loss harvesting to legally minimize tax liabilities.

7. Considering an Estate Plan

Make arrangements for the benefit and protection of your heirs. This varies based on life stage and personal circumstances like marriage, children, or legacy goals.

8. Monitoring and Adjusting Your Financial Plan

Revisit your plan at least annually and more often if changes in circumstances affect your financial situation. Adjust the plan as needed to keep it working efficiently and effectively.

Conclusion

A financial plan is an essential tool for your financial well-being, now and into the future. It involves setting down the current state of your finances, your financial goals, and methods to achieve them. Regardless of your financial situation, creating a financial plan can help you meet your financial needs through all life stages, ensuring financial success and security