Adapting to Changing Needs

One of the most important aspects of conducting a regular budget review is adjusting your budget categories to reflect your changing needs and goals. Your budget is not a static…

Strategies for Paying Off Debt

One of the most important aspects of a budget review is assessing your debt management. Debt can be a major source of stress and financial burden, especially if you have high-interest rates,…

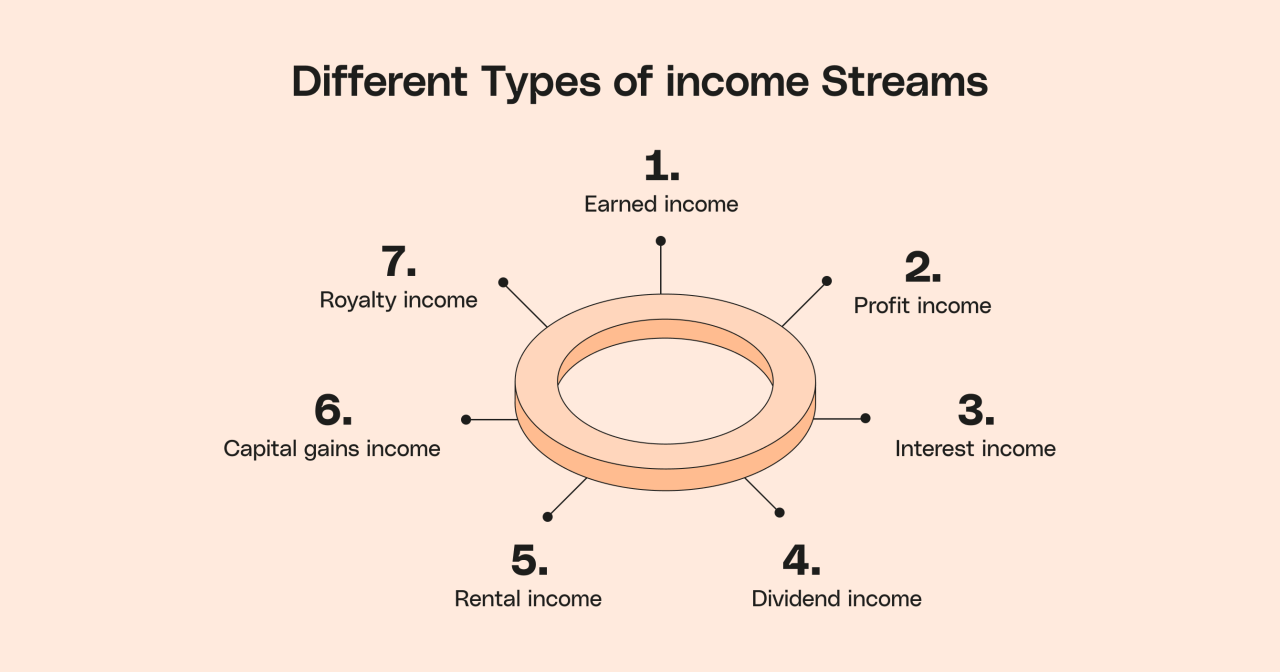

Maximize Your Returns

One of the most important aspects of a regular budget review is to evaluate your savings and investments and see how they are performing. Are you saving enough for your short-term and…

Identifying Areas for Improvement

One of the most important steps in conducting a budget review is evaluating your spending habits. This will help you identify where you are overspending, where you can save more, and…

Analyzing Your Cash Flow

One of the most important aspects of conducting a regular budget review is tracking your income and expenses. This will help you to understand your cash flow, which is the difference between…

Do you Align Your Budget with Your Objective

One of the most important aspects of conducting and benefiting from a regular budget review is setting clear and realistic financial goals. Financial goals are the specific outcomes that…

Budget review: How to conduct and benefit from a regular budget review

The Importance of Regular Budget Reviews A budget is a plan that outlines how much money you expect to earn and spend over a certain period of time, usually a…

How To Stop Struggling With Financial Discipline

“Discipline is the bridge between goals and accomplishment.” – Jim Rohn. Financial discipline is one very important aspect of personal finance that plays a vital role in securing your financial…

Terms and Conditions

Terms and Conditions of Use Welcome to MaertinK Resource Center (referred to as “the Website”). By accessing this Website (www.keemstar.co.ke) and using our services, you agree to comply with and…

Do you have an emergency fund?

An emergency fund is a financial safety net you can rely on if a major unexpected event happens in your life. At the same time, it can help you earn…

Mastering Financial IQ: Lessons from Robert Kiyosaki

Mastering Financial IQ: Lessons from Robert Kiyosaki What Money Lessons Can The Richest Man in Babylon Teach Us About Building Wealth?

What Money Lessons Can The Richest Man in Babylon Teach Us About Building Wealth? Can ETFs Make You Rich? Exploring 5 ETF Types for Long-Term Wealth

Can ETFs Make You Rich? Exploring 5 ETF Types for Long-Term Wealth