Optimizing Your SACCO Membership: Share Capital vs. Savings for Maximum Returns

When considering the best strategy for maximizing your returns in a Savings and Credit Cooperative Organization (SACCO), it’s crucial to understand the dynamics between share capital and savings. While both…

“Debt: The Controversial Tool of Wealth Creation Explained”

In the realm of personal finance, few topics stir as much debate as debt. From cautionary tales to success stories, debt is often portrayed as a double-edged sword—one that can…

“Mastering Wealth: Robert Kiyosaki’s Guide to Investing and Using Other People’s Money (OPM)”

In the realm of personal finance and investment strategies, Robert Kiyosaki stands as a prominent figure, best known for his groundbreaking book “Rich Dad, Poor Dad.” Recently, Kiyosaki released a…

The Hidden Secrets of Financial Education: A Journey from Debt to Wealth

## The Hidden Secrets of Financial Education: A Journey from Debt to Wealth In today’s world, financial education remains a mystery to many, but understanding it can open doors to…

Start Doing This Today! “You Will Never Be Poor Again”

### Start Doing This Today! “You Will Never Be Poor Again” The educational system often fails to provide comprehensive financial literacy, leaving many in the dark about managing money, investing, and…

Strategies for Paying Off Debt

One of the most important aspects of a budget review is assessing your debt management. Debt can be a major source of stress and financial burden, especially if you have high-interest rates,…

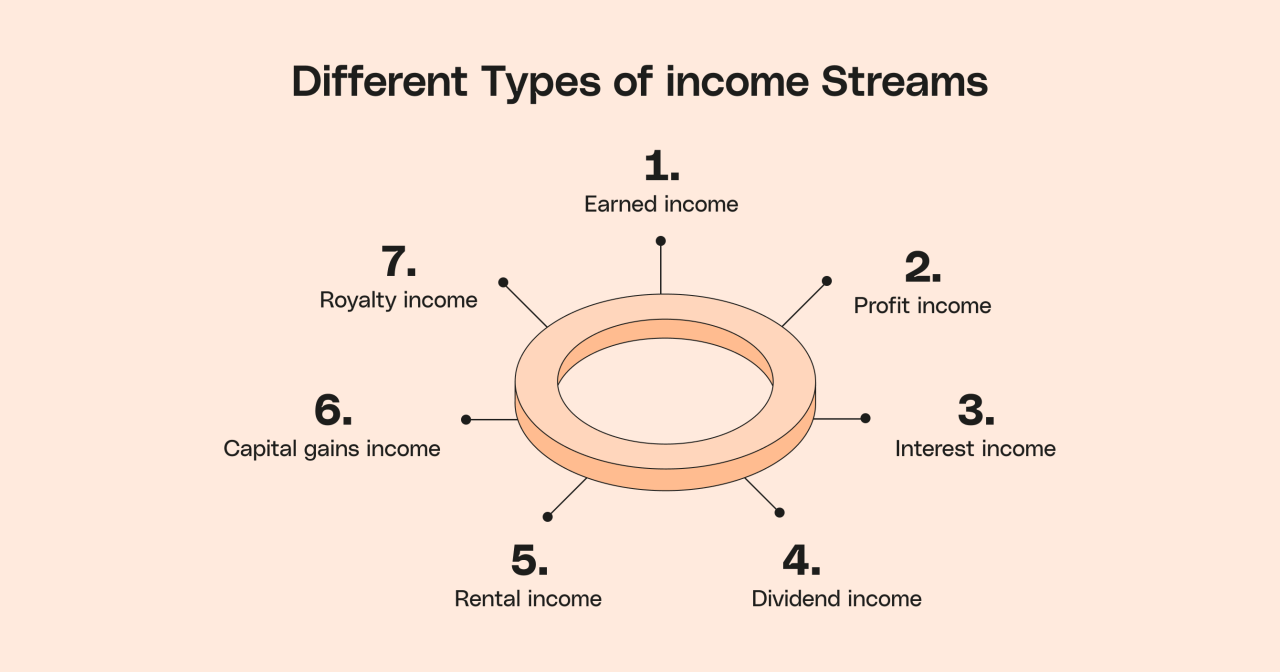

Building Wealth From A Modest Salary

Building wealth from a modest salary is indeed possible. Let’s explore some practical steps: Live Within Your Means: Spend less than what you earn. Avoid credit card debt and focus…

A significant number of individuals fail to pose insightful inquiries during the concluding phase of employment interviews.

However, it presents an excellent chance to distinguish oneself. And it is the distinguishing factor between average prospects and those who are essential to hire. Presented below are ten inquiries…

Your 30s Bring New Financial Challenges And Opportunities. Here Are Important Financial Guidelines:

Define Your Priorities for Spending: You should have a clear understanding of your values and the kind of lifestyle you want to pursue at this point. Spend no more money…

Methods for Developing a Financial Strategy

Developing a financial plan requires taking a number of specific measures. The following are some extra plan aspects and procedures that should be included in addition to the calculations of…

Mastering Financial IQ: Lessons from Robert Kiyosaki

Mastering Financial IQ: Lessons from Robert Kiyosaki What Money Lessons Can The Richest Man in Babylon Teach Us About Building Wealth?

What Money Lessons Can The Richest Man in Babylon Teach Us About Building Wealth? Can ETFs Make You Rich? Exploring 5 ETF Types for Long-Term Wealth

Can ETFs Make You Rich? Exploring 5 ETF Types for Long-Term Wealth