Simplifying Your Investment Strategy: A Guide for Every Investor

Simplifying Your Investment Strategy: A Guide for Every Investor Investing doesn’t have to be complicated. By understanding the basic principles and choosing the right investment vehicles, you can build a…

Monthly Salary vs. Drawings: What’s Best for Your Business?

How Should You Pay Yourself as a Business Owner: Salary vs. Drawings As a business owner, deciding how to pay yourself is a critical financial decision. Two common methods are…

Achieving Long-Term Financial Stability with Tax-Free Government Bonds: A Guide to Monthly Investments

Securing long-term financial stability is a prudent goal, and one effective way to achieve it is through strategic investments. Government bonds, particularly those offering tax-free interest, are a reliable and…

What is a diversified portfolio and why is it important?

Understanding the Importance of a Diversified Portfolio A diversified portfolio is a cornerstone of prudent investing, designed to spread risk across various asset classes, industries, and geographic regions. This strategy…

How much should I invest in stocks vs. bonds?

Determining Your Stock vs. Bond Allocation: A Guide to Balancing Risk and Return Investing in stocks and bonds is a fundamental strategy for building a diversified portfolio that balances risk…

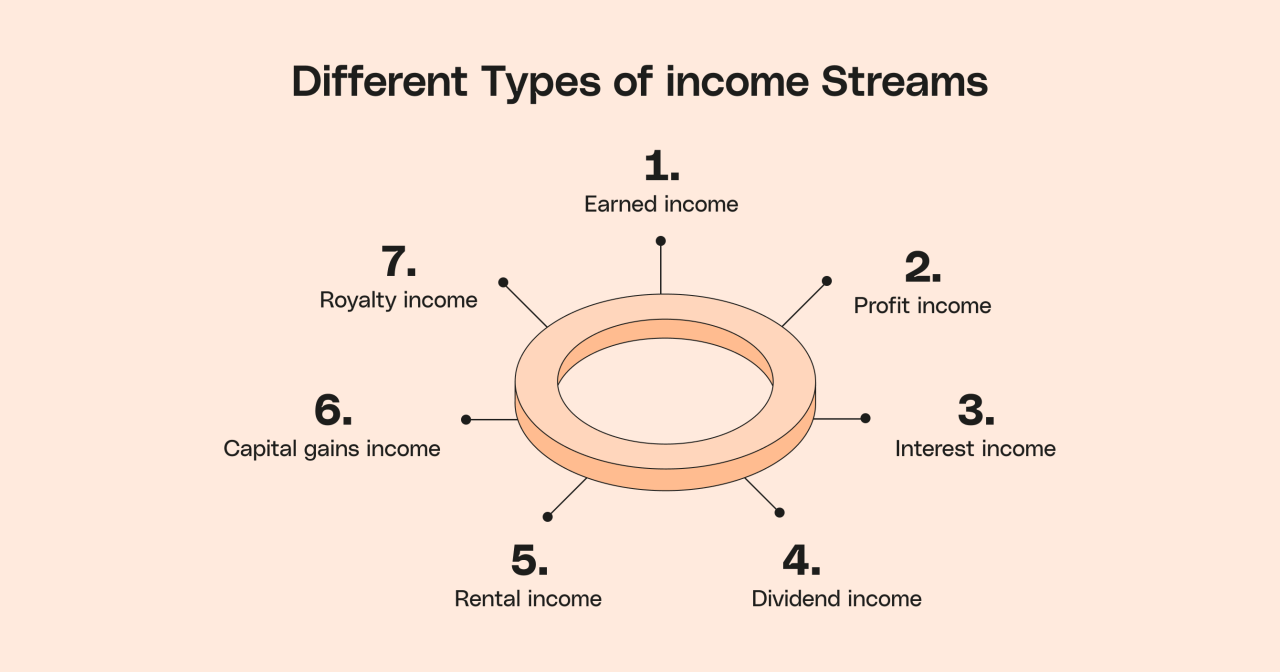

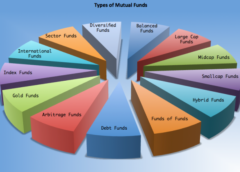

What are the different types of investments?

Understanding Different Types of Investments Investing is a crucial aspect of building wealth and achieving financial goals, but navigating the diverse landscape of investment options can be overwhelming for beginners.…

How do I start investing?

Getting Started with Investing: A Beginner’s Guide Investing is a powerful tool for building wealth over time, but for beginners, it can seem daunting. Understanding the basics and having a…

What are the best strategies for managing credit card debt?

Strategies for Managing Credit Card Debt Effectively Managing credit card debt is a crucial aspect of personal finance that requires a strategic approach to reduce balances, minimize interest costs, and…

Should I prioritize paying off debt or saving for emergencies?

Prioritizing Debt Repayment vs. Building an Emergency Fund: A Strategic Approach When managing your finances, deciding between paying off debt or saving for emergencies requires careful consideration of your financial…

How can I pay off my debt faster?

Strategies to Pay Off Debt Faster: Achieve Financial Freedom Sooner Paying off debt faster can help you save money on interest, reduce financial stress, and achieve your financial goals sooner.…

Mastering Financial IQ: Lessons from Robert Kiyosaki

Mastering Financial IQ: Lessons from Robert Kiyosaki What Money Lessons Can The Richest Man in Babylon Teach Us About Building Wealth?

What Money Lessons Can The Richest Man in Babylon Teach Us About Building Wealth? Can ETFs Make You Rich? Exploring 5 ETF Types for Long-Term Wealth

Can ETFs Make You Rich? Exploring 5 ETF Types for Long-Term Wealth