Milestones to Achieve by Age 30: Setting Yourself Up for Success and Fulfillment

As you approach your 30s, it’s crucial to lay the groundwork for a successful and fulfilling life. Here are nine key milestones to strive for by the age of 30:…

Essential Advice for 20-Somethings: Navigating Early Employment and Financial Independence

Entering the workforce in your 20s is an exciting yet challenging phase of life. Here are some crucial tips to help you thrive during this early stage of your career…

Building a Solid Foundation: Financial Tips for Newly Employed 25-Year-Olds

As a newly employed 25-year-old, setting a strong foundation for your future starts with prioritizing essentials and making smart investments. Here’s a guide to help you navigate this exciting phase…

Unlock Your Potential: How Anyone Can Start Investing Today

In today’s world, investing isn’t just for the wealthy or the financially savvy—it’s for everyone willing to take the first step towards securing their financial future. By committing to a…

Proven Strategies for Building Long-Term Wealth

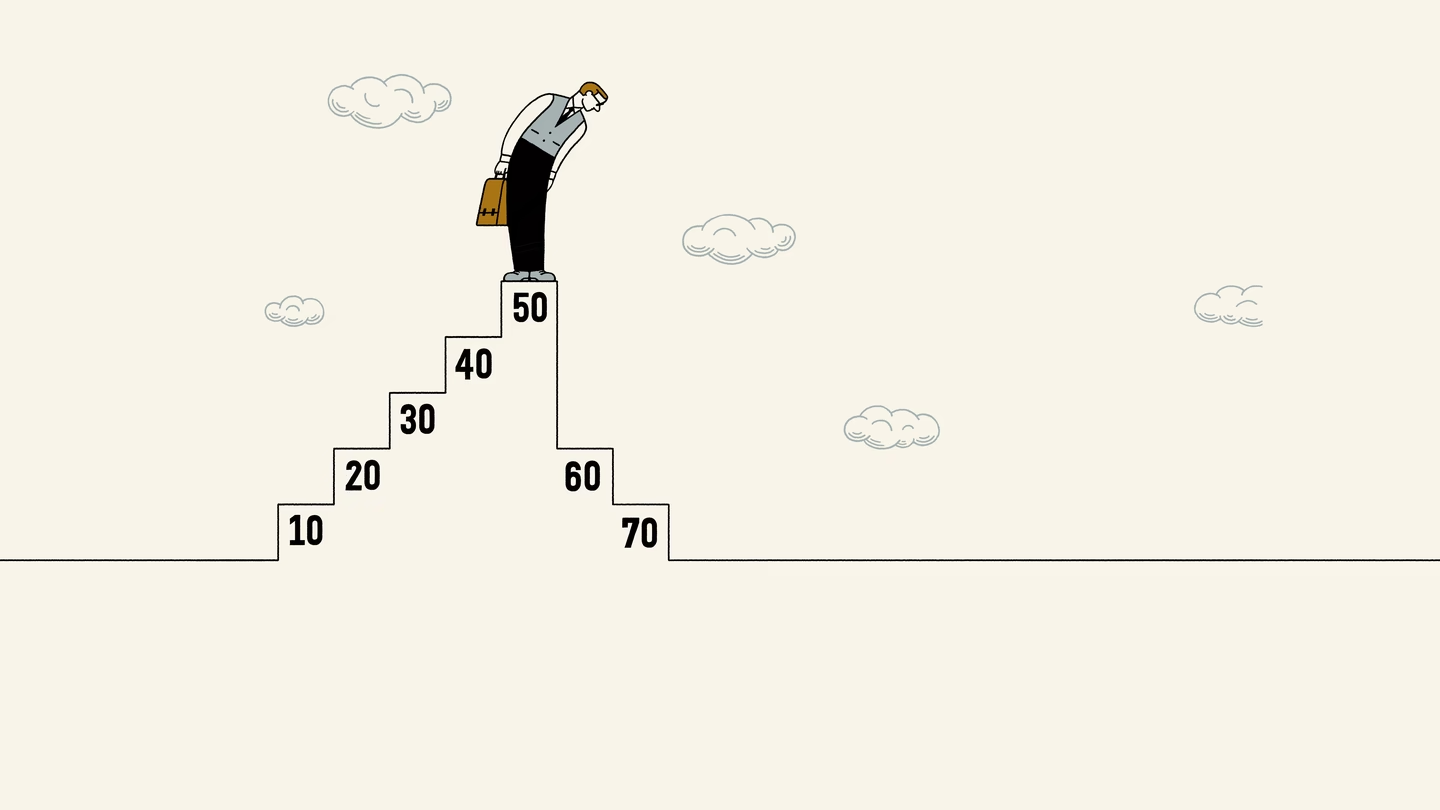

Building wealth is a goal many aspire to achieve, yet it often seems elusive. The journey to financial stability and prosperity is a marathon, not a sprint. Here are five…

Building Wealth: A Self-Paced Marathon, Not a Sprint

Building wealth is a journey that requires patience, discipline, and strategic planning. Here are essential principles to guide you on your path to financial independence: Wealth Creation as a Marathon,…

How can you save money if the debt is straining you?

Strategies to Save Money When Debt is Straining Your Finances Debt can be a significant burden, making it challenging to save money and achieve financial goals. However, with strategic planning…

Breaking Free from 9-5: Building Wealth Beyond the Day Job

Working a traditional 9-5 job doesn’t have to limit your financial potential. In fact, it can be a stepping stone to achieving greater wealth and financial independence. Here’s how you…

The Power of Financial Freedom: Breaking Free from Toxic Relationships and Environments

Achieving financial freedom isn’t just about reaching a monetary milestone—it’s about gaining independence and the ability to make choices that align with your well-being and values. For many, financial freedom…

Financial Discipline: Unlocking Choices and Freedom

Financial discipline is not just about managing money; it’s about gaining control over your life and creating opportunities for greater freedom and independence. When you prioritize financial empowerment, you open…