The Art of Living Within Your Means: Embracing a Sustainable Lifestyle

In a world driven by consumerism and the relentless pursuit of material wealth, it’s easy to fall into the trap of living beyond our means. However, the true essence…

## Loving Parents Should Provide Their Children with Financial Literacy, Not Just Buying Them Toys

### Introduction In today’s fast-paced and consumer-driven world, it’s easy for parents to get caught up in the cycle of buying their children the latest toys and gadgets. While…

Mastering Money Management: Essential Practices for Business Owners

Running a business is one of the most rewarding experiences you can have, but it also comes with its fair share of challenges. One of the biggest hurdles many…

Strive for Financial Balance This New Month

Achieving financial balance is essential for both short-term satisfaction and long-term wealth. This new month, aim to use your income wisely by following a simple yet effective formula: Pay Bills…

Simplifying Your Financial System: A Guide to Easy Money Management

One common mistake I see my clients make is overcomplicating their finances. Many believe that the more accounts and investments they have, the more successful they’ll be. This couldn’t…

The Unconventional Path to Success: Lessons from Robert Kiyosaki’s Top Ten Rules of Success

Robert Kiyosaki, the renowned author of *Rich Dad Poor Dad*, has profoundly influenced millions worldwide with his innovative views on real estate, money, and entrepreneurship. His insights have challenged conventional…

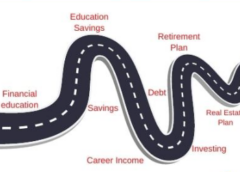

Crafting Your Path to Financial Success: A Comprehensive Guide to Financial Planning

A financial plan is a crucial document detailing a person’s current financial circumstances and their short- and long-term monetary goals, along with strategies to achieve those goals. This guide will…

What Are The Best Personal Finance Apps to Manage Your Money

In today’s digital age, managing your personal finances has never been easier, thanks to the plethora of personal finance apps available. Whether you want to track your spending, create a…

How Do I Improve My Credit Score?

Your credit score is a crucial aspect of your financial health, impacting your ability to secure loans, obtain favorable interest rates, and even rent an apartment. Improving your credit score…

How Can I Save Money Effectively?

Saving money effectively is a fundamental aspect of personal finance that can significantly impact your financial stability and future prosperity. Whether you’re looking to build an emergency fund, save for…