The Formula for Financial Freedom: Sacrifice, Discipline, Patience, and Consistency

Achieving financial freedom and building wealth is not just about having a good job or making smart investments. It’s about developing the right mindset and mastering four essential qualities: sacrifice,…

Top Tax-Free Investment Options in Kenya: Maximize Returns with Government Bonds, Savings Accounts, and REITs

Tax-free investments in Kenya offer an excellent opportunity to grow your wealth while minimizing your tax burden. From government bonds to real estate investment trusts (REITs) and savings accounts, these…

The Path to Financial Freedom: Key Steps to Take

Achieving financial freedom is a goal many aspire to, but few truly attain. It’s not just about having money; it’s about developing a mindset and habits that lead to lasting…

How to Save for Your Child’s Education: A Comprehensive Guide

How Do I Save for My Child’s Education? Saving for your child’s education is one of the most important financial goals you can set. With the rising costs of tuition,…

Avoid These Financial Mistakes to Build Lasting Wealth

Effective money management is crucial for building and maintaining wealth. Unfortunately, many individuals fall into common financial traps that hinder their financial progress. Here are ten mistakes to avoid to…

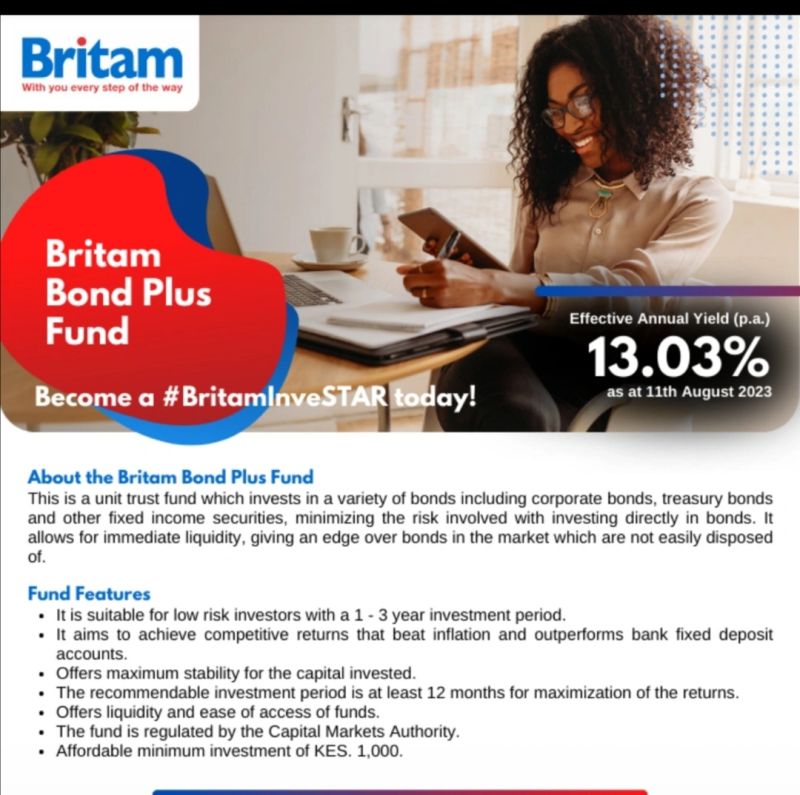

Creating Wealth with Britam BondPlus Fund: A Step-by-Step Guide

Unlock the potential of the Britam BondPlus Fund to create wealth. Learn strategic investment tips, understand the benefits of fixed-income securities, and discover how to maximize returns while managing risk.…

Understanding Britam BondPlus: A Comprehensive Guide for Investors

Investing in bonds can be a strategic way to balance your investment portfolio, providing stability and steady income. One notable option in the East African region is Britam BondPlus, an…

Achieving Long-Term Financial Stability with Tax-Free Government Bonds: A Guide to Monthly Investments

Securing long-term financial stability is a prudent goal, and one effective way to achieve it is through strategic investments. Government bonds, particularly those offering tax-free interest, are a reliable and…

What is a diversified portfolio and why is it important?

Understanding the Importance of a Diversified Portfolio A diversified portfolio is a cornerstone of prudent investing, designed to spread risk across various asset classes, industries, and geographic regions. This strategy…

Taking Control of Your Finances: A Practical Guide to Budgeting and Saving

Do you find yourself constantly broke despite earning a decent salary? If so, you are not alone. Managing finances effectively is a common challenge, but with a few strategic steps,…