Why Many Don’t Use the 50/30/20 Rule and Why It Doesn’t Work for Everyone

Why Many Don’t Use the 50/30/20 Rule and Why It Doesn’t Work for Everyone Introduction Budgeting is a crucial financial practice, yet many people struggle to create and stick to…

How to Save Money Effectively: Smart Strategies for Financial Success

How to Save Money Effectively: Smart Strategies for Financial Success In today’s fast-paced world, managing finances wisely is essential for achieving financial stability and reaching long-term goals. Whether you’re saving…

Budget Your Money to Become a Saver

Saving money is a critical skill that anyone can develop with the right tools and strategies. Whether you’re just starting to build your savings or trying to save more consistently,…

How to Create a Budget That Works: Step-by-Step Guide for Managing Finances on a Salary and Achieving Financial Freedom

Creating a budget is a key step toward financial freedom. It helps you manage your salary effectively, control spending, and build savings. Here’s a step-by-step guide to help you create…

Automate Your Wealth: The 75-15-10 Money Management Strategy

In today’s fast-paced financial landscape, many people find themselves in a cycle of earning and spending, often wondering where all their money has gone. The majority of individuals typically earn…

How much should I save each month?

How Much Should You Save Each Month? A Comprehensive Guide The amount you should save each month depends on your financial goals, income, expenses, and overall financial situation. Here are…

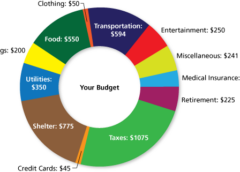

How do I create a budget?

Creating a Budget: A Step-by-Step Guide to Managing Your Personal Finances Creating a budget is a crucial step in managing your personal finances effectively. Whether you’re trying to save for…

What percentage of my income should go towards different expenses?

## How to Stick to a Budget: Practical Tips for Success Creating a budget is an important step towards financial stability, but sticking to it can often be challenging.…

How to Stick to a Budget: A Comprehensive Guide

Budgeting is a powerful tool that can help you take control of your finances, save money, and achieve your financial goals. However, sticking to a budget can often be challenging.…

How to Start a Budget: A Step-by-Step Guide to Financial Freedom

Creating a budget is one of the most fundamental steps towards achieving financial stability and freedom. Whether you are a beginner or have attempted budgeting before without much success, this…