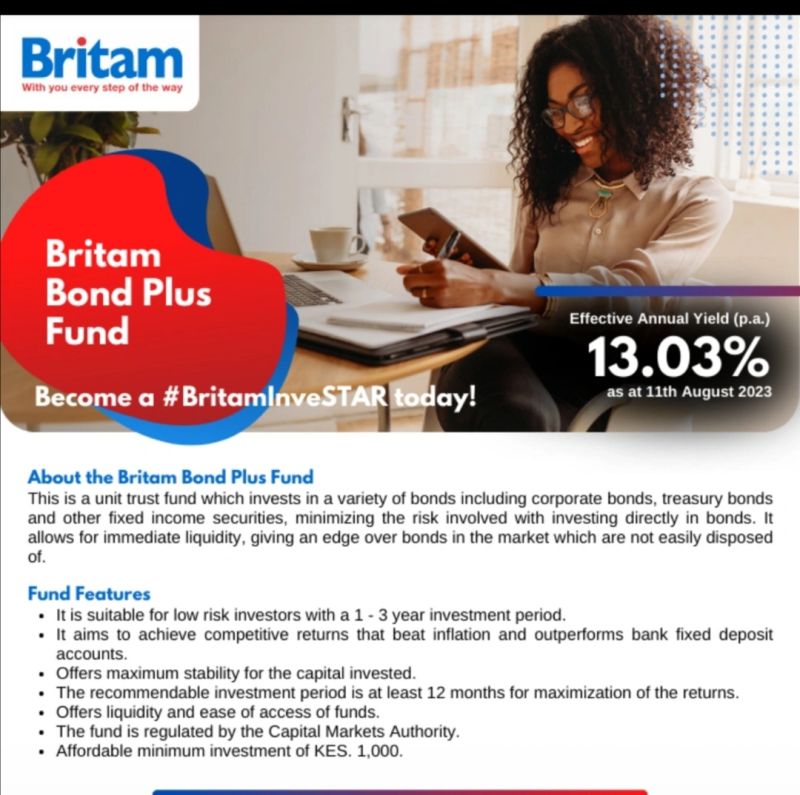

Investing in bonds can be a strategic way to balance your investment portfolio, providing stability and steady income. One notable option in the East African region is Britam BondPlus, an investment product designed to offer a diversified portfolio of bonds and other fixed-income securities. Here, we delve into the key aspects of Britam BondPlus that every potential investor should know.

Objective

The primary objective of Britam BondPlus is to provide investors with regular income and capital preservation. This is achieved through carefully selected investments in fixed-income securities, ensuring a balanced approach to risk and return.

Investment Portfolio

Britam BondPlus invests in a variety of fixed-income instruments, including government bonds, corporate bonds, and other securities. This diversified approach helps to mitigate risk while aiming to deliver consistent returns.

Risk Profile

With a moderate risk profile, Britam BondPlus offers a safer alternative to equity investments. However, investors should be aware of risks associated with interest rate changes, credit risk, and inflation, which can impact bond prices and returns.

Returns

Returns from Britam BondPlus come from interest income generated by the bonds and potential capital gains from bond price appreciation. These returns are typically more stable compared to those from equity investments, making the fund an attractive option for conservative investors.

Liquidity

Britam BondPlus offers liquidity, allowing investors to redeem their investments under specified conditions. It is essential to review the terms regarding redemption fees or lock-in periods to understand the full implications of withdrawing funds.

Investment Horizon

The fund is best suited for investors with a medium to long-term investment horizon, ideally three to five years or more. This duration allows the fund to navigate interest rate cycles and bond market fluctuations effectively, enhancing the potential for stable returns.

Management Fees

Like all managed funds, Britam BondPlus charges management fees to cover professional management and administrative expenses. Prospective investors should review the fee structure to understand its impact on net returns.

Minimum Investment

Britam BondPlus requires a minimum investment amount, which can vary. Checking the current requirements before investing is crucial to ensure you meet the entry threshold.

Regulation and Safety

Regulated by the Capital Markets Authority (CMA) in Kenya, Britam BondPlus operates within a legal framework and adheres to strict governance standards, ensuring a level of safety and oversight for investors.

Tax Implications

Interest income from bonds is generally subject to taxation. Understanding the tax implications is essential for assessing the net returns on your investment in Britam BondPlus.

Diversification

Investing in Britam BondPlus offers diversification benefits, as the fund invests in a range of bonds. This reduces the impact of any single bond defaulting, providing a more stable investment environment.

Suitability

Britam BondPlus is suitable for conservative investors seeking steady income, retirees looking for regular payouts, or anyone aiming to balance a more aggressive equity portfolio with stable fixed-income securities.

Before investing in Britam BondPlus, it’s crucial to review the fund’s prospectus, understand the terms and conditions, and consider consulting with a financial advisor. This ensures the investment aligns with your goals and risk tolerance, helping you make an informed decision.

Invest wisely with Britam BondPlus and enjoy the benefits of a diversified bond portfolio designed for steady income and capital preservation.